Vern Edwards

Members-

Posts

2,667 -

Joined

-

Last visited

Content Type

Profiles

Forums

Blogs

Events

Store

Breaking News

Everything posted by Vern Edwards

-

8(a) Sole Source POM/PNM and POP Commencement

Vern Edwards replied to CaptJax's topic in Contract Award Process

I do. It was done by people who didn't know what they were doing. The story of our times. -

8(a) Sole Source POM/PNM and POP Commencement

Vern Edwards replied to CaptJax's topic in Contract Award Process

Emphasis added. Then it's not a service contract. It's a supply contract. See FAR 2.101: Emphasis added. If the doors are standard and require only minor modifications, then you could conduct the procurement under FAR Part 12 as one for commercial products. -

Well, not manually. There is software that can do it. There are several such programs

-

What do you mean by "types" (plural) of G&A? G&A consists of a company's pool of expenses that cannot be allocated to specific cost objectives, so is allocated to the business as a whole. See FAR 2.101 and 31.201-4(c), and FAR (CAS) 9904.410. For a specific contract with a specific business there is only one "type" of G&A.

-

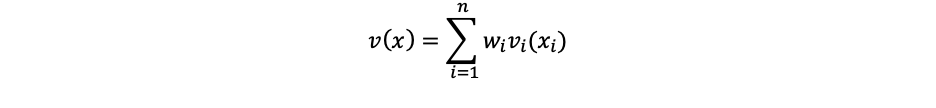

According to von Winterfeldt and Edwards (no relation to me) in Decision Analysis and Behavioral Research (Cambridge University Press, 1986):

-

Instead of counting pages, do a word count. But that takes a special effort.

-

8(a) Sole Source POM/PNM and POP Commencement

Vern Edwards replied to CaptJax's topic in Contract Award Process

@CaptJaxAccording to FAR 15.000, a negotiated contract is any that is awarded using other than sealed bidding, and Part 15 prescribes policies and procedures for both competitive and noncompetitive negotiated acquisitions. Thus, according to FAR 15.400, the policies and procedures in FAR Subpart 15.4 apply to your 8(a) negotiation, even if it's for a commercial service. See FAR 12.203(a): Emphasis added. The KO is the one who must sign the contract. See FAR 1.602-1(b). And see FAR 15.405(a): "Taking into consideration the advisory recommendations, reports of contributing specialists, and the current status of the contractor’s purchasing system, the contracting officer is responsible for exercising the requisite judgment needed to reach a negotiated settlement with the offeror and is solely responsible for the final price agreement." Since the CO, not you, must put his name on the contract, and since he has decided what is appropriate, why not just do as you're told and stop your anonymous whining here. When you work for someone, work for them. -

In 1984, in the GPO pamphlet format, FAR Vol. I, Parts 1 - 51 was 1,276 pages; Vol II, Parts 52 - 99 was 552 pages, for a total of 1,828 pages. In 2020, in the GPO pamphlet format, FAR Vol 1 was 1,148 pages; Vol II was 525 pages, for a total of 1,683 pages. Those page counts include covers and all front and back matter. So in that format the FAR shrank. I did not investigate further. The pamphlet edition for 2021 is not yet available. The current edition will grow some when they add the new Part 40.

-

You'd have to decide what versions of the FAR to check. You'd probably have to check the official CFR version published by the GPO. Should be easy to do, though tedious. It would be easier just to check the 1984 version against the 2020 or 2021 version. But page counts won't tell the whole story.

-

8(a) Sole Source POM/PNM and POP Commencement

Vern Edwards replied to CaptJax's topic in Contract Award Process

😂 Just call me Lamp-post. -

The OP said: I answered: Then you-know-who came in with this b.s.: Bull----! In response to which I cited several cases in which boards of contract appeals, the Court of Federal Claims, and the Federal Circuit have said, over the course of decades, that making the contractor whole was the very purpose of an equitable adjustment. Making them "whole" means putting them back into the position they were in before the Change. It does not mean turning a losing job into a winner or depriving a contractor of what it's entitled to in order to negotiate what a CO thinks is a new reasonable price. Let me remind everyone of what Prof. Nash said:

-

@ji20874I did not pretend to be disappointed in you. I expressed confusion about your ideas. What was especially confusing was your statement that: Equitable adjustment is not about price reasonableness. It's about cost compensation. I did not make a belated "admission" of anything. No "admission" was necessary. Don't try to cover what was either ignorance or poor professional communication by insulting me. I described a complicated idea that you apparently did not know or failed to address. I did it in detail and in appropriate terms. I provided a number of references to court decisions in which the topic was extensively covered. If "allowable" was a key word for you, why didn't you use it? I tried to be tactful in not saying that your statement about the "paramount purpose" of an equitable adjustment was misleading and in saying that I must have misunderstood you. You like to provide terse, often information-free responses to inquiries. I like to provide extensive, detailed, and well-documented ones, and I did it in this, in two lengthy posts. It's a good thing that some of us try to actually be informative. But a person can only inform about what they know.

-

@ji20874 No, not unless the contracting officer is a fool, because: Tolliver Group, Inc. v. U.S., 149 Fed. Cl. 520 (2018). A contractor is not entitled to an equitable adjustment as compensation for its own incompetence. It's entitled to an equitable adjustment as compensation for things the government caused and is liable for that have increased its costs or the time it needs to perform. ji20874, what I'm telling you is well-established in the law. It's not new and it's not controversial. I'm frankly surprised to be having this discussion with you. I suspect that I must not understand your meaning or that you have not fully expressed your thinking. What the point is that you are trying to make, I encourage you to think it through and try to restate it more definitively. Professor Nash discussed the concept of equitable adjustment in a 2019 article, "Equitable Adjustment: Costs or Value," The Nash & Cibinic Report, August 2019, in which he quoted the ASBCA in Kellogg Brown & Root Services, Inc., ASBCA 57530, 19-1 BCA ¶ 37,205, 2018 WL 6431434, 61 GC ¶ 138(a). He then went on to say: When the government causes the contractor to incur allowable costs that it was not originally obligated to incur, the contracting officer must "make the contractor whole" by increasing the contract price to cover those allowable costs and to provide a reasonable additional profit. That is the essential purpose of equitable adjustment. And that is an ancient tenet of government contract law. COs who negotiate equitable adjustments must know and adhere to it.

-

Ummm, I don't know about that. See Kellogg Brown & Root Services, Inc., 19-1 BCA P 37205, ASBCA 57530, Nov. 19. 2018: States Roofing Corp., 08-2 BCA P 33970 ASBCA No. 55506 September 16, 2008: and H.K. Ferguson Co., 57-1 BCA P 1293, ASBCA No. 2826, March 29, 1957. Note the range of dates. That is long standing principle. See United States ex re;. Patzer v. Sikorsky Aircraft Corp., United States District Court, E.D. Wisconsin.November 29, 2021, 571 F.Supp.3d 979: I can quote from many other decisions of other boards of contract appeals, the Court of Federal Claims, the Federal Circuit, and Cibinic and Nash, and Nash and Feldman, that say the same thing. But I would say that the principle purpose of an equitable adjustment is to compensate the parties for the effects of changes on the costs of performance. The contractor is compensated for any increase, the government is compensated for any decrease. It is not about price reasonableness, as that concept is generally understood.

-

The home page. He doesn't mention the Forum.

-

Emphasis added. The answer to that question depends on the terms of the MATOC and what you mean by "subject to." Does the MATOC contain any clause stating that changes will be priced based on the contract rates? If so, then you must price the change at those rates. If not, then the adjustment is not limited by the contract rates, but the rates may still be a factor in pricing the adjustment. The contracting officer may want to use them as standards of cost reasonableness. Generally, the amount of an equitable adjustment is determined by the impact on the contractor. See the Changes clause, 52.243-1, paragraph (b): Emphasis added. The standard formula for pricing an equitable adjustment is described in FAR 15.408, Table 15-2, Section III, Formats for Submissions of Line Item Summaries, Subsection B, Change Orders, Modifications, and Claims. Basically, the adjustment is the difference between what the work would have cost before the change and what it will (or did) cost after the change, plus a reasonable adjustment to profit. If you have already performed the changed work, then you must show the CO the difference between (1) what you estimate that it would have cost to do the work before the change (not the amount you included in your original proposal) and (2) what it did cost to do the work as changed. You must show that your estimate and your actuals are reasonable. Additionally, some agencies include a clause in their contracts that applies the FAR Part 31 contract cost principles and procedures to the pricing of adjustments. See, e.g., DFARS 252.243-7001, Pricing of Contract Modifications. See, generally, Administration of Government Contracts, 5th ed., Chapter 9, Pricing of Adjustments; Section I.A., Price Adjustments Under Contract Clauses; Section II., Proof of Adjustment; Section IV., Overhead and Profit; and Section VI., Costs of Preparing and Financing Adjustments.

-

8(a) Sole Source POM/PNM and POP Commencement

Vern Edwards replied to CaptJax's topic in Contract Award Process

It was part of the FY2017 NDAA. FY 2017!!! It's clearly not a priority. They're probably having trouble defining "commercial construction service." -

8(a) Sole Source POM/PNM and POP Commencement

Vern Edwards replied to CaptJax's topic in Contract Award Process

Emphasis added. Note that the phase "commercial item" is no longer in official use. We're talking about commercial product or commercial service. @C CulhamOkay, I'll take a shot, even though I know that once you have made up your mind and committed yourself to a position, as you have in this case, you will never change it. I am really writing this for others. The reason the acquisition cannot be for a commercial service contract is because the work, as described by the OP, fits the FAR definition of construction. Here is the definition of construction from FAR 2.101, which applies throughout the FAR (see FAR 1.108(a) and FAR 2.000): A $500,000 project to replace weathered doors at a military installation (remove old doors and install new ones) would clearly require alteration and/or repair of real property. So it meets the FAR definition of construction. Is construction a commercial service? See the definition in FAR 2.101. FAR Part 12 does not mention construction as a commercial service. FAR Part 36 says nothing about construction being a commercial service. FAR does not define service, but it does define service contract at FAR 37.101, and that definition includes "Maintenance, overhaul, repair, servicing, rehabilitation, salvage, modernization, or modification of supplies, systems, or equipment," [emphasis added] but not of real property. Is the agency buying commercial doors, and is the project the installation of a commercial product and thus a commercial service? I don't know. The OP did not describe the doors in detail. I don't know if the project involves doors of a single type and description or various kinds of doors. I don't know if they are special-order of commercial off-the-shelf. Given that the doors are for a military installation, I presume that they are heavy-duty doors, not the kind that go into ordinary houses. I don't know if the contractor will have to alter any door frames in order to install the new doors. I don't know what kinds of equipment the contractor will require. However, FAR 2.101 defines a commercial product in part as follows: I wonder if the doors in question are customarily used by the general public. How much tailoring of FAR 52.212-4 would be necessary in order to protect the government's interests. At what point would the CO have to do so much tailoring in order to protect the government's interests that the advantages of using FAR Part 12 would be lost? Would the CO need to add coverage for bonds and liquidated damages, or should the CO forego such protections? What kinds of laborers would be needed? Would the Service Contract Act or the Davis-Bacon Act apply? What would your friends at the Department of Labor say? FAR 52.212-5 makes provision for including the SCA in contracts for commercial services, but not Davis-Bacon. What does that tell you? Would SCA wage determinations be appropriate for a $500,000 construction job. See Voith Hydro, Inc., B-401771, November 13, 2009, in which the protester complained that an acquisition being conducted under FAR Part 15 as construction should have been acquired under FAR Part 12: FASA and FAR Part 12 were not written with construction in mind. Construction is defined in FAR and does not constitute a commercial service. Using Part 12 to buy construction would create more issues and problems than it would solve, except for very minor jobs, such as I mentioned in my last post. I could go on, but I think I have made my point. Readers can take it or leave it. But, Carl, we all know that you will stand fast and to the death. So I'm not really writing for you. In any case, after more than 28 years the policy makers have not seen fit to clear things up, and agencies will do as they like. -

Subcontractor, independent consultant, materialman

Vern Edwards replied to lotus's topic in For Beginners Only

@lotusSometimes yes, and sometimes no. -

Subcontractor, independent consultant, materialman

Vern Edwards replied to lotus's topic in For Beginners Only

@lotusRead the definition of subcontractor at FAR 44.101 and then tell us what you think. -

Distinguishing FAR Part 12 from FAR Part15 Contracts

Vern Edwards replied to AspiringGovKr's topic in For Beginners Only

If the contract was awarded on SF1449, then it is most likely safe to assume that the award was for a commercial item under Part 12. If it was awarded on SF33, and block 4 indicates the contract was negotiated, then it is most likely safe to assume that the award was made pursuant to FAR Part 15. Your assumption may turn out to be incorrect in a few cases, but that won't be your fault.

.gif)