Sam101

-

Posts

144 -

Joined

-

Last visited

Content Type

Profiles

Forums

Blogs

Events

Store

Breaking News

Posts posted by Sam101

-

-

9 hours ago, Don Mansfield said:

What do you mean by "best"? The offeror with the lowest price?

In the case of LPTA, yes, the lowest price as long as they meet the minimum criteria, i.e., technically acceptable. In the case of trade-off it would not necessarily be the lowest price.

-

45 minutes ago, joel hoffman said:

(1) The agency can comprehensively and clearly describe the minimum requirements in terms of performance objectives, measures, and standards that will be used to determine the acceptability of offers; [thus, IMHO, your Section M doesn’t comply with this requirement]

You got me, thank you Joel... I messed up on the RFQ, the only thing I can say is that since no pre-award protest was filed then I should be safe documenting the award decision and hope for the best.

-

Thank you Joel,

Your post is very informative, thank you. I just have one question, does the fact that it's a request for quote make the original post's propositions true or false?

-

Or perhaps there is such a thing as technically acceptable corporate experience price trade-off, or technically acceptable key personnel price trade-off, or technically acceptable technical approach price trade-off... FAR 15.100 Scope of subpart says "This subpart describes some of the acquisition processes and techniques that may be used to design competitive acquisition strategies suitable for the specific circumstances of the acquisition."... the word "some" may imply that technically acceptable key personnel price trade-off is OK.

-

5 hours ago, C Culham said:

because by using some of FAR part 15 (LPTA) you made it so, correct?

I never thought about that but now my mind is blown... if not using LPTA or trade-off (including technically acceptable past performance price trade-off) then what are you using? Something with no name? FAR 13.106-1(a)(2)(i) just says the CO shall notify potential quoters or offerors of the basis on which award will be made and FAR 13.106-1(a)(2)(ii) says Contracting officers are encouraged to use best value, and best value is defined as "Best value means the expected outcome of an acquisition that, in the Government's estimation, provides the greatest overall benefit in response to the requirement." in FAR part 2.

I never seen this in any solicitation but does using FAR 13 with no FAR part 15 implications mean that the solicitation can just say "award will be made to the quoter that has the lowest price and is technically acceptable"?... and then magically the propositions in the original post are true?

6 hours ago, C Culham said:Really? So you are saying that if one has corporate experience that trumps a responsibility determination? I fear you have not correctly interpreted FAR 9.1 and would suggest a close read would support that responsibility is the higher bar.

I'm not saying that having a good rating on a corporate experience evaluation factor trumps the entirety of FAR 9.104-1 General standards as in everything in (a) - (g)... I'm just saying it would probably trump just (e)'s "experience"... but not all of (e) because (e) contains organization, accounting and operational controls, and technical skills, or the ability to obtain them on top of "experience".

4 hours ago, Don Mansfield said:Why do you think that?

Because having a corporate experience evaluation factor allows the government to choose the best contractor to perform the responsibility determination on.

-

39 minutes ago, Vern Edwards said:

Am I correct in thinking that you are a government contract specialist?

Yes, I'm a Contracting Officer.

-

22 hours ago, joel hoffman said:

You repeatedly referred to “proposals”, not “quotes”, “offerors” , not “quoters”, Part 15 source selection procedures, and case law for a Part 15, best value trade-off acquisition.

Fair enough, however in my original post I was only referring to "offerors".

22 hours ago, joel hoffman said:and case law for a Part 15, best value trade-off acquisition.

Right, but from B-418229,B-418229.2 the full text is this, emphasis added:

QuoteIn a negotiated procurement, an agency is required to identify the bases upon which offerors’ proposals will be evaluated and to evaluate offers in accordance with the stated evaluation criteria. Competition in Contracting Act of 1984, 41 U.S.C. § 3306(b)(1)(A); FAR §§ 15.304(d), 15.305(a); A-P-T Research, Inc., B-414825, B-414825.2, Sept. 27, 2017, 2017 CPD ¶ 337 at 4; Northrop Grumman Info. Tech., Inc., B-400134.10, Aug. 18, 2009, 2009 CPD ¶ 167 at 5. An agency’s chosen evaluation rating scheme, however, is not the stated evaluation criteria, nor need it be disclosed in the solicitation.

A negotiated procurement can be LPTA can't it?

22 hours ago, joel hoffman said:It would have been nice to know that you were talking about commercial item/service “quotes”, not an LPTA Part 15, source selection process.

Why would commercial vs. non-commercial, or Simplified Acquisition Procedures vs. FAR 15 make a difference as to whether or not propositions [1], [2], and [3] are true? Does the fact that it's a commercial buy magically make it true and if it's a non-commercial buy it magically makes it false? Or if it's FAR 13 it's true but FAR 15 makes it false? I don't think that it matters, it's either true or false no matter what FAR part you're using or if it's proposals or quotes or commercial or not.

16 hours ago, Don Mansfield said:Isn't the Government already making this determination when applying the responsibility standard stated at FAR 9.104-1(e)?

I suppose so, however I always think of responsibility determinations as a lower bar than having corporate experience as an evaluation factor even for LPTA.

-

Thank you Vern,

12 minutes ago, Vern Edwards said:Thus, I think a protest tribunal might well find your propositions [1], [2], and [3] to be invalid. (Not "true".)

I see this statement in many GAO cases, emphasis added:

QuoteIn reviewing a protest challenging an agency’s evaluation, our Office will not reevaluate proposals, nor substitute our judgment for that of the agency, as the evaluation of proposals is a matter within the agency’s discretion.

14 minutes ago, Vern Edwards said:Although the RFP does not define "sufficient," RFP Sections L and M, read together, might be interpreted to mean that in order to be "sufficient" an offeror's experience must include three relevant instances of performance. the protest tribunals interpret the RFPs as a whole.

The best bet to be on the safe side is to re-solicit and relax the corporate experience factor, however I won't re-solicit because I don't have time and it's not out of the realm of possibility that my propositions [1], [2], and [3] are valid, i.e., "true".

-

Thank you Joel,

10 hours ago, joel hoffman said:FAR 15.101-2 Lowest price technically acceptable source selection process.

Emphasis added:

10 hours ago, joel hoffman said:(3) The agency believes the technical proposals will require no, or minimal, subjective judgment by the source selection authority as to the desirability of one offeror's proposal versus a competing proposal;

I don't want to be in a situation where all proposals received do not have all three of their past contracts indicating that they were performing them for at least three years... that would mean that I would need to re-solicit, note that corporate experience is not the only evaluation factor, I have multiple very concrete evaluation factors, I just want the corporate experience factor to be flexible to avoid having to award to an offeror just because they have three contracts that meet the three year performance requirement while another offeror has only two out of the three that meets the requirements while being rated technically acceptable for the other factors.

Actually, I already received the quotes (it was an RFQ in real life) and I don't have time to re-solicit, all quotes received did not meet the three year requirement for all three past contracts, that means all quotes would be unacceptable if the rating definitions looked like Choice 2 in my original post.

58 minutes ago, joel hoffman said:Why would you expect industry to spend money and resources to prepare technical and price proposals without knowing what is “sufficient experience” or what is “relevant experience” ?

The quoters will look at the RFQ's SOW and know that if their past contracts were similar then this will be determined to be sufficient and relevant experience.

1 hour ago, joel hoffman said:Why would you expect industry to spend money and resources to prepare technical and price proposals without knowing what is “sufficient experience” or what is “relevant experience” ?

Gamble.

-

Say you have an LPTA solicitation that has section L and M looking like this:

Section L:

L.1 Corporate Experience: Offerors shall describe three past relevant contracts that they have been performing for at least three years.

Section M:

M.1 Corporate Experience: The government will determine whether the offeror has sufficient experience based on the three past contracts that they described.

Choice 1 Rating Definitions:

Acceptable: The offeror meets requirements.

Unacceptable: The offeror does not meet requirements.

In this case, the government is free to rate offerors Acceptable even if only one out of their three past contracts are determined to be relevant. And further, Offeror A can be rated Acceptable because only one out of their three past contracts are determined to be relevant, and Offeror B can be rated Acceptable because two out of their three past contracts are determined to be relevant, because the two contracts combined “meets the requirements”, but not by themselves like in Offeror A’s case, and Offeror C can be rated Acceptable because all three of their past contracts were determined to be relevant.

Choice 2 Rating Definitions:

Acceptable: All three past contracts are relevant.

Unacceptable: Not all three past contracts are relevant.

Then an offeror cannot be rated acceptable unless all three of their past contracts were determined to be relevant.

This is my question:

So, it’s better for the solicitation to have the Choice 1 Rating Definitions if the government evaluators want more flexibility in determining who is technically acceptable, correct?

Answering my own question:

I am 99.9% sure that the answer to my question is “yes” because of this:

FAR 15.304(d) says this, emphasis added:

QuoteAll factors and significant subfactors that will affect contract award and their relative importance shall be stated clearly in the solicitation ( 10 U.S.C. 3206(b)(1) and 41 U.S.C. 3306(b)(1)) (see 15.204-5(c)). The rating method need not be disclosed in the solicitation. The general approach for evaluating past performance information shall be described.

From GAO case U.S. Facilities, Inc. B-418229; B-418229.2:

QuoteAn agency’s chosen evaluation rating scheme, however, is not the stated evaluation criteria, nor need it be disclosed in the solicitation.

QuoteCompetitive prejudice is an essential element of a viable protest; where the protester fails to demonstrate that, but for the agency’s actions, it would have had a substantial chance of receiving the award, there is no basis for finding prejudice, and our Office will not sustain the protest.

Is anything that is written above "This is my question:" not true?

-

52 minutes ago, Retreadfed said:

Are you thinking about a contract awarded using sealed bids or a negotiated contract? If the latter, remember that award is to be made to the offeror whose proposal offers the best value to the government.

Negotiated... when I said lowest price wins I meant in a scenario where the government can't wordsmith their way into awarding to a "higher" priced offeror.

-

11 hours ago, Retreadfed said:

See FAR 32.107.

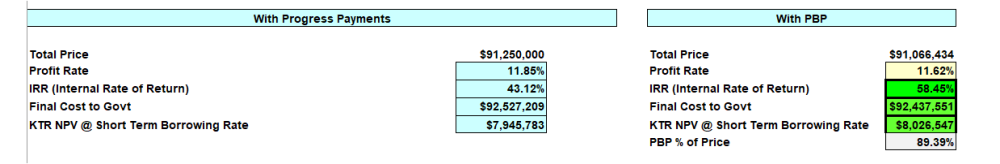

Thank you, I forgot about that... but wait, I just realized that the Final Cost to the Govt with PBP says $92,437,551.00 and even with progress payments it's $92,527,209.00.

So wouldn't that mean that if an offeror said that they do not need any government financing and they price their proposal at $92,400,000.00 they would still win because they are the lowest "evaluated price"? If this is not the case then there is no point of the "Final Cost to Govt" field.

I might be not understanding something, but to me this "imputed" Final Cost to Govt is "fake" because the government already has this money and really isn't borrowing it from anywhere. It's just a calculation to comply with FAR 32.205. Or is this the wrong way to think about this?

-

Lets say that the awarded price is $91,066.434.00 because the offeror said in their proposal that they will use PBP.

But what if Offeror A chooses to use PBP in their proposal and their evaluated price is $91,066.434.00 but Offeror B says in their proposal that they do not need any financing and their proposed and therefore evaluated price is $92,000,000.00.

Is section M allowed to say that offerors who do not need government financing will be evaluated more favorably? In which case the government can safely award to Offeror B? Or is the government not allowed to favor offerors who do not need financing?

-

On 12/12/2022 at 6:52 PM, here_2_help said:

With respect to performance-based payments, DoD mandates the use of a "tool" (spreadsheet) that takes into account both the contractor's interest rate on its borrowings as well as the A-94 interest rate. No I don't know the rationale for doing so. Most of how DoD implements PBPs is a mystery to me. I just know that the spreadsheet exists and can be accessed by those who need to use it.

Thanks H2H.

So, with the proposed price on the SF33 is $91,250,000. The win-win solution with PBP says $91,066,434.

But am I understanding correctly that the government still awards the contract (i.e., obligates) $91,250,000.00? And then during performance the PBPs will look exactly like on cells in column H? But the invoice payments in column I (i.e., DD 250) will have an extra invoice for the $183,566.00 difference?

-

Thanks everyone, but just on a side note, I just don't understand why if a contract is awarded for $5M, why can't the government just front (place the money in the contractor's bank account) the entire $5M to the contractor at time of award and let them do whatever they want with it?

If the contractor isn't performing well then have a special button that the government clicks that automatically takes whatever is remaining in that account and then let the contractor find their own financing for the remainder of the contract, and then request that the money expended by the contractor be paid back if they default.

Like this:

1) Total FFP award: $5M, 3 year period of performance.

2) Place $5M in contractor's special account.

3) The contractor isn't performing well on the 16th month, there is $3M remaining in the contractor's special account because the contractor expended (physically spent) $2M already.

4) The government clicks a button on a special website and $3M automatically disappears from the contractor's special account and the contractor needs to now find their own financing for the remainder of the contract.

5) All goes well and 30 days after completion of the contract the government pays $3M to the contractor and everyone is happy.

OR

5) The contractor defaults, so the government does not pay the $3M and just keeps it and on top of that requests that the $2M not taken by the special button click be paid back to the government.

I don't think that this will ever be adopted into the FAR because it's too simple and makes too much sense.

-

@Retreadfed, to answer your question about why I said "And in the case of any other form of financing it would involve interest, and that it one of the interest rates in OMB Circular A-94", it was a wrong assumption on my part, there is no clause.

Upon further reading it appears to me as though interest and "imputed cost" to the government is only for evaluation purpose when the government lets offerors propose their own financing terms with their proposals. This confuses me because if there is no real consequence of "imputed cost" post award, then saying "this proposal has $X imputed cost to the government" just for evaluation purposes is meaningless.

For example, if Offeror A's proposed price is $1M and Offeror B's proposed price is $1.3M, then after the procedure in FAR 32.205(c) Offeror A's "evaluated price" is $1.4M and Offeror B's "evaluated price" is $1.2M then the award will go to Offeror B (given that Offeror A's non-price ratings do not warrant an award to the "higher" offer) but the actual obligated amount will be $1.3M when the government could have awarded to Offeror A at $1M if it weren't for FAR 32.205(c).

How does letting offerors state their own finance terms introduce "imputed costs" into the evaluation while when the government states the finance terms the "imputed costs" magically disappear?

And if you award a contract without financing and then do a mod to allow financing then what? The government and contractor just agree to something without worrying about FAR 32.205(c)?

On 12/9/2022 at 11:02 AM, ji20874 said:Sam101, Are you asking about (a) pre-award evaluation; (b) post-award administration; or (c) something else?

I am asking about (a) pre-award evaluation and (b) post-award administration.

On 12/9/2022 at 4:07 PM, here_2_help said:Are we talking about cost-based customary progress payments or are we talking about performance-based payments? This reader is confused.

Both. And also commercial interim payments.

-

Thanks C Culham, yes, the link helps but I read it 100 times before.

This is how I understand it, I'm probably wrong, and if I'm wrong it's the documentation's/FAR's fault for being too difficult to understand:

Contract awarded FFP: $1M, meaning progress payments can't go over $900,000.00 (90% of $1M)

Assuming the contractor asks for the entire 90%:

Progress payment 1: $300,000.00 ($900,000.00 / 3)

Progress payment 2: $300,000.00 ($900,000.00 / 3)

Progress payment 3: $300,000.00 ($900,000.00 / 3)

Invoice payment 1 (and final, upon completion of the contract): $100,000.00 ($1M - $900,000.00)

And in the case of any other form of financing it would involve interest, and that it one of the interest rates in OMB Circular A-94, for example 1.3% for anything up to 3 years? So it will look like this:

Contract proposed amount FFP: $1M, meaning finance payments can't go over $900,000.00 (90% of $1M)

Assuming the contractor asks for the entire 90%:

$900,000.00 * 1.3% = $11,700.00 (or whatever the interest formula is)

$1M - $11,700.00 = $988,300.00 is the new contracted amount.

Then the $988,300.00 is gradually paid at agreed to intervals as long as the sum of all finance payments do not exceed the total incurred costs of performance and whatever is left is paid in response to the first and final invoice.

If it's not this way then it should be... but with the amount of documentation on this topic I have a feeling that there is way more to this.

-

This is probably the dumbest question on this forum but I just can't wrap my mind around the concept of how the time value of money, net present value, OMB Circular A-94, discount rate, etc. ties into situations where the government provides contract financing... what exactly is the government borrowing and from who?

Say the IGCE is $1M, you already have the $1M on a requisition, you award the contract and obligate that $1M that you already have, then you make a few interim commercial payments, progress payments, or performance based payments, whichever of those you are using... OK, so what does something like "nominal discount rate specified in Appendix C of the Office of Management and Budget (OMB) Circular A-94, "Guidelines and Discount Rates for Benefit-Cost Analysis of Federal Programs," appropriate to the period of contract financing" from FAR 32.205( c )(4) have to do with the fact that you already have funds obligated to the contract and you're simply just paying the contractor before final delivery and if they don't deliver they will just pay the government back?... What does "nominal discount rate" and strange finance jargon have to do with any of this?

I'm not looking for a complex in-depth lesson on FAR 32, I was just hoping to kind of get a very high level understanding to where I can do my own research.

For example, is the government actually lending money to the contractor at a very low rate and the interest that the contractor owes the government is just deducted from the contract price? I hope this isn't the case, because that would just confuse me even more but this is the type of high level answer I'm looking for.

-

Use FAR 8.4 for commercial products and services, if market research shows you that you have a very good chance of obtaining at least 3 quotes from GSA Schedule contract holders AND that the product or service is within scope of their GSA Schedule. I would suggest to get on conference calls with 4 or 5 vendors and make sure that they can point you to where it says in their Schedule pricelist that they have the product or labor categories to perform the scope of work, and that they are interested in submitting a quote if an RFQ is issued.

FAR 16.5 is for IDIQs, an agency can award its own IDIQ and then after it's awarded then follow the procedures in FAR 16.5 for issuing task orders.

Another way to do FAR 16.5 is by using government-wide IDIQs like OASIS and STARS, but you need a Delegation of Procurement Authority (DPA) for those, I don't have one but it looks like you have to take some class to get a DPA. Some government-wide IDIQs may allow for non-commercial scopes of work, unlike GSA Schedules (FAR 8.4) which only allow commercial products and services.

-

On 10/5/2022 at 6:35 PM, Spring2242 said:

This process may result in a gap in coverage of 1-3 months.

Is the SOW for severable or non-severable services? Maybe the government should terminate the contract for default, or de-scope the work and deobligate unused funds. Or extend the period of performance at no additional cost to the government to make up for those months and adjust the invoice schedule as a result also.

On 10/5/2022 at 6:35 PM, Spring2242 said:This may be due to the onboarding of new contractor personnel, which routinely occurs at the beginning of the task order.

Award the task order on November 01, 2022 but make the period of performance start on December 01, 2022, if it would take 1 month to get employees on board, background checks, badging, network access, etc. Or you can make the transition-in period its own labor hour CLIN if things are really uncertain, and then have the actual work be firm fixed price.

On 10/5/2022 at 6:35 PM, Spring2242 said:the Government is required

No it's not.

-

2 hours ago, Vern Edwards said:

First, what was the holding in Optimus and how does it apply to your scenario?

The holding was that the government asking for only price reductions without allowing changing anything else in a quotation after the submission of initial quotations does not constitute discussions. This applies to my scenario because the government is asking Vendor A for a price reduction only, without allowing them to change anything else in their quotation, after submission of initial quotations.

-

2 hours ago, Vern Edwards said:

Do you know of any decision(s) which have made a holding based on the current FAR that would support what you want to do?

Yes, DarkStar Intelligence, LLC B-420609,B-420609.2, which is from 2022, where the GAO said this:

QuoteProtest alleging that the agency conducted discussions with only the awardee is denied where the exchange was a request for a price reduction conducted after the agency had selected the awardee under Federal Acquisition Regulation subpart 8.4.

QuoteWe conclude that there was no prejudice to the protester because the agency requested the price reductions from ChESS only after selecting that vendor for award.

Quotethe agency requested that ChESS further improve its already successful quotation by quoting the agency a lower price. The record establishes that even if the request had not been made, ChESS’s quotation would have been selected for issuance of the task order.

2 hours ago, Vern Edwards said:the text of FAR 8.405-2(c)(3)(ii), which the GAO cited in Optimus, has changed.

Yes, but 8.405-4 Price reductions says "the ordering activity shall seek a price reduction when the order or BPA exceeds the simplified acquisition threshold."

2 hours ago, Vern Edwards said:The issue is fairness. See FAR 1.102-2(c) and 1.602-2(b).

Asking for a price reduction doesn't violate integrity, fairness, and openness, it's just following what "8.405-4 Price reductions" says and giving tax payers better performance at a lower rate.

I don't see how asking for price reductions would violate ensuring that contractors receive impartial, fair, and equitable treatment, competitors see that FAR 8.405-4 says that the government can ask for price reductions at any time before placing an order or establishing a BPA... so it's fair. Would it make a difference if the reason for asking for specific rate discounts was because the CO looked at the GSA CALC Tool and saw that the average for awarded rates were closer to Vendor B's rates?

I'm not sure what "price reduction conducted after the agency had selected the awardee" means in DarkStar Intelligence, LLC B-420609,B-420609.2 though, does it mean that even if the awardee said no to any price reductions that the agency would still be forced to award to them?

-

3 hours ago, Vern Edwards said:

When you ask, "Can the CO...," are you asking whether it would be okay with the GAO or the COFC?

Yes, I am asking if it would be OK with GAO or the COFC and also if it's OK with the any plain text in FAR 8.4. I think at least it's OK with GAO, because of B-400777 Optimus Corporation.

3 hours ago, Vern Edwards said:you must always be fair to all competitors, no matter what procedure you use. Don't you agree?

Yes, the government should always be fair to all competitors.

3 hours ago, Vern Edwards said:Is it fair competition, even under FAR Subpart 8.4, to bargain with Vendor A to get a lower price without bargaining with Vendor B to get a better technical approach?

I would say it's better to enter into discussions with both Vendor A and Vendor B and let Vendor A decrease their price and let Vendor B propose a better technical approach, but sometimes it's better not to have discussions, whether that is because of time or something else.

3 hours ago, Vern Edwards said:How would you answer that question if asked by a protest tribunal?

I would say "because it was not in the best interest of the government to enter into discussions, FAR 8.4 is not meant for discussions, if I knew that this procurement had a good chance of needing discussions I would not have used FAR 8.4, rather I would have used FAR 15."

-

You can probably find some evidence about how to go about invoicing for a firm fixed price contract in USCOFC case # 2020-1815 Pacific Coast Community v. US.

This case basically says that the government can have invoicing look more like labor hour even on firm fixed price contracts.

.gif)

Broad LPTA rating definitions

in For Beginners Only

Posted

Well, no, because the threshold for technical responsibility might be higher than it is for FAR 9.104-1(e)’s “experience”, here is an example:

Technical Acceptability’s Corporate Experience: The government will determine whether the offeror has at least three years of experience cooking beef.

FAR 9.104-1(e)’s “experience”:

1) Does the apparent awardee have the at least three years of experience cooking beef? No. They only have two years of experience.

2) Does the apparent awardee have the at least three years of experience cooking any sort of meat? Yes.

3) Does the apparent awardee’s project manager have at least three years of experience cooking beef? Yes.

That’s two “yes” and one “no”, that is pretty good, I guess they are well of their way to being found responsible because they have 1/5 of FAR 9.104-1(e) covered.