-

Posts

3,051 -

Joined

-

Last visited

Content Type

Profiles

Forums

Blogs

Events

Store

Breaking News

Posts posted by here_2_help

-

-

1 hour ago, Retreadfed said:

H2H, I generally agree with what you have written. However, I do not understand this sentence. Can you explain what you meant by it?

If the contractor fails to comply with the LoC or LoF clause (as applicable) then the government is not obligated to provide additional funds but the contractor is still expected to perform the contracted work. In the event performance costs more than available contract funds, then the contractor will incur a loss on performance of the work. I'm talking about project gross margin erosion into negative territory.

Okay?

-

21 hours ago, OuterSpace said:

We have a 5 year CPFF contract for approx $10m. As I understand it, the Fee is fixed, so if our rates increase during the life of the contract, this would eat in to our Fee. Or do we get a chance to bill at the new higher rates, and increase the fee as well (or would this only apply to a cost plus percentage of cost)?

At this point, you have a contract with both (1) an estimated cost and (2) a fixed fee amount. During performance, if your costs increase (because, say, your indirect rates were higher than you expected) you may still bill those costs (assuming they are allowable, reasonable, etc., as ji20874 wrote) up to either (a) the amount funded if incrementally funded or else (b) the full amount of your estimated costs.

HOWEVER, if your contract includes 52.232-20 or 52.232-22, then you must comply with those clauses. Normally (with a few exceptions for unforeseen situations) you must notify your customer before spending all the money. If you adhere to the notification requirements, the customer may choose to fund an overrun (regardless of cause); but it need not and then you stop work when you have no more funds or have reached the total estimated cost of the contract. In that manner, your fixed fee is preserved. Note that if your contract includes either or both of those clauses (and it should), then your failure to comply essentially converts your CPFF contract into a FFP contract and you must deliver and the customer has no obligation to fund any overrun/cost growth whatsoever.

Increasing indirect rates just burns the available contract funds faster than planned. Whether that situation impacts your expected profit largely depends on your ability to comply with those contract clauses I cited above.

-

KatzM -- You are asking a question of law and there are no lawyers here who have agreed to provide you or your company with legal advice/assistance. I urge you to obtain the answer to your question from competent legal counsel.

-

5 hours ago, Vern Edwards said:

But is it the same material cost? I buy something for $1000. Then I sell it to someone else for that amount. They use it to make something new, then sell it to me for $1,500. I then make some changes to the thing and sell it to someone else for $2,000. It seems to me that the buyer's only question should be whether $2,000 is fair and reasonable.

I suspect that I'm being simple-minded, but where am I going wrong?

Vern, the issue is that the first company is not selling the materiel to just anybody; they are selling it to a supplier who then sells it back. This is not necessarily a problem but it could be. And if you'll refer to my first response under this thread, I think you'll find that we are in agreement from the buyer's perspective. I was focusing on the accountant's perspective, as I tend to do.

-

2 hours ago, Vern Edwards said:

@here_2_helpWhy would you be "concerned"? Do you think those things violate a law, a regulation, or an accounting principle? How does the amount affect the propriety of the transaction?

I'm not challenging, just asking.

Fair question.

First, I only care if amounts are "material" as defined by FAR 30.602 (which directs a contracting office to 48 CFR 9903.305 in CAS-land). If the amounts are not material, then I am not concerned. (Note I will try to use "materiel" for goods to distinguish between goods and the concept of materiality.)

To your question: The goal of any indirect rate is to allocate costs across many "cost objects" (let's call them contracts) in reasonable proportion to the benefits received. (Ref. FAR 31.203(c).) The costs in the indirect pools are, generally, related to functions and activities. For example, a materiel burden pool may contain the costs of purchasing, quality control, and other activities related to acquiring and using materiel. In my view, when the materiel was originally acquired it was properly burdened with the costs of those functions/activities. Then the materiel was sold to a supplier. Then the supplier returned the materiel in the form of a finished good. Unless the contractor is careful, that same original materiel cost will be burdened again.

That's not a problem so much for the government, because all the contractor is doing is increasing the denominator of its indirect cost rate calculation, but it could result in excess indirect costs being allocated to the contract with this relatively infrequent transaction type while other contracts receive relatively less indirect cost allocations.

The issue with double-counting the revenue should be fairly obvious. A succinct summary with a good example is found here. There are other articles available.

QuoteThe error of double counting occurs when the value added by a certain activity in the production chain is added twice. For instance, the value of bread sold is inclusive of the value of the flour, the manufacturing, the packaging, and transport. If we added the cost of transport once again to the final value of bread, the error of double-counting has been committed.

-

Patrick,

You haven't made the case for why this is in the government customer's best interest. Why is this transaction being done? Who saves money? Who saves schedule?

My recommendation is to start by building the business case for why this makes sense. Perhaps then you will be able to refute the "perception problem" your former DCAA auditors are concerned about.

I will share that I have dealt with this situation a couple of times before. In each case, there was a business justification/rationale for the prime selling stuff to the subKtr, who then refined it and sold it back. In each case, we were able to show that the government customer was not paying any more for the end item deliverable than would have been the case if the subKtr had purchased the material input on its own--even with profit added. In fact, we were able to show significant schedule advantages to doing what we wanted to do. Since it was in our government customer's best interest, there were no concerns expressed.

-

This issue arises frequently because most larger contractors are both competitors and teammates on different contracts, often concurrently. For example, Raytheon may provide avionics to Lockheed Martin while competing against Boeing on a new missile procurement. Typically, the problem is solved by having DCAA audit the major subcontractor proposals rather than having the prime's people do it. This strategy is generally accepted by all the parties (including USG) at the larger contractor levels. Remember, these larger contractors already have cadres of DCAA auditors in their facilities on a daily basis. What's one more audit?

Any small contractor that wants to use this strategy is likely to be laughed at.

In my experience, the solution for smaller contractors is to execute a Non-Disclosure Agreement, allowing certain prime contractor personnel to review the full detailed proposal support in order to perform cost analysis, while providing assurance that the information will not be used to the future competitive disadvantage of the entity that submitted it.

-

I have seen a couple of civilian agency contracts (for A/E Services) that prohibit a "consultant" from billing fee/profit for its "subconsultants." However, the prohibition is express--i.e., it's right there from the time of contract formation. Nobody is relying on FAR or an Agency Supplement as the basis for the treatment; it's simply a contract term.

Unless the contract specifies otherwise, subcontractor profit is simply a cost to the prime (or higher-tier subcontractor). That said, of course Vern is right that "excessive pass-through" costs, which are defined in FAR clauses he references, are unallowable. (NB: It has always bothered me that the excessive pass-through clauses are found in Part 15 vice Part 31.)

Hope this helps.

-

6 hours ago, Patrick Mathern said:

One of our clients is providing material to their sub at cost. There is no business relationship between the two entities other than as Prime and Sub (this cannot be viewed as an intercompany transfer in any way). Here's a simplified version of what's going on:

- Prime purchases material from distributor for $1,000

- Prime sells to Sub for $1,000 cost

- Sub adds value of $500 (including labor and/or other materials, OH, G&A, and profit)

- Sub sells to Prime for $1,500

- Prime sells to end customer for $2,000 (including added labor, material, OH, G&A, and profit)

I'm being told by two "former DCAA auditors" that this is not in alignment with far and is also "unethical." Their view is that the Prime-Sub relationship counts as a "Related Entity" and therefore the sub must sell back to the Prime at cost. Their view is that the arrangement as outlined above is "double dipping."

Your two former DCAA auditors are wrong. A prime/sub relationship does not an "affiliated entity under common control" make.

Determining whether there is common control is fact-dependent and requires the exercise of judgment. That said, "Entities that are consolidated by the same parent—or that would be consolidated, if consolidated financial statements were required to be prepared by the parent or controlling party—are considered to be under common control." [Source: PricewaterhouseCoopers website.]

The way you describe the transaction, there is no double-dipping. If the subK purchased the material from the distributor on its own, it would pay $1,000 and add $500 in value, and then it would sell the finished good to the prime for $1,500. There is nothing unethical going on here that I can see.

However, you have skipped over any discussion of rate impacts, and revenue recognition. In the scenario you describe, the prime has counted the same material cost twice in its indirect rate allocation base--once when it purchases the material and then again when it accepts the subcontractor's finished goods. In my view, that's a problem if the amounts are significant. Also, the prime seems to have recorded revenue twice as well--once when it sells $1,000 of material to the subK and then again when it sells $2,000 worth of product to the end customer. I would be concerned about those impacts.

Hope this helps.

-

47 minutes ago, ji20874 said:

Government property may be divided into government-furnished property and contractor-acquired property. The equipment you are talking about is not CAP, and is not government property at all -- the FAR's Government Property clause does not apply.

Yes, the contractor keeps the property at contract end, but not because of anything in the Government Property clause. The contractor is free to sell or re-purpose the property at any time, before, during, or after contract performance.

Even if it were CAP, which it isn't, you would not need a separate CLIN for CAP.

You must not think of this property as CAP. It isn't.

Does the government want to take possession of this equipment?

Maybe, maybe not. What about when there are progress payments?

-

I don't think there is a definitive answer to the question, and I like ji20874's response. I also hear "wrap-rate" used frequently--though interpretations of that term vary.

-

Not sure if this is a DoD procurement, but see DFARS PGI 215.404-3

-

I don't know a regulation or clause that gives a CO authority to direct the contract type between a Prime and SubK. However, the SubK may have to be submitted for consent in advance of award, right? So ... it seems to me that the Prime should be prepared to justify the contract type used.

Also, I wonder if the Prime understands WHY it wants to award a T&M SubK instead of a CPFF one. What is the big benefit?

-

41 minutes ago, Don Mansfield said:

If they overbill their indirect costs, the Government would be credited. However, you're not going to know that until the final indirect cost rates are determined. I would let that process work itself out.

In the meantime, I would consider revising the billing rates (see FAR 42.704(c)). I see this as a billing rates issue--not a cost allowability issue.

Don, I find myself in the position of once again disagreeing with your advice. Unless the contracting officer with cognizance over this contract is also the same contracting officer with cognizance over the contractor's final billing rate proposal and negotiation of final billing rates (see 42.705-1), I don't believe they have authority under 42.704 to issue a unilateral indirect rate determination. I base my position on the language at 42.704(a).

QuoteThe contracting officer (or cognizant Federal agency official) or auditor responsible under 42.705 for establishing the final indirect cost rates also shall be responsible for determining the billing rates.

I note that the original poster used the term "telework" which seems ambiguous. Does telework mean the contractor's employees are working from their own homes, or does it mean they are working from their offices at the contractor's facilities? I don't know. I also don't know whether the contractor is maintaining office space for its employees since they are not working at the government's facilities. That is a key unknown fact. If the contractor maintains office space for its employees then it would be reasonable and appropriate for it to bill the contract at higher indirect rates that include its facilities costs.

To me, this issue should have been raised and addressed by the parties back in 2020, when the contractor began teleworking routinely. Now, here we are, two or three years later, trying to fix something that I'm not even sure is a problem.

The contract appears to be silent regarding the ratio of onsite and offsite work -- though the parties must have had a notion as to what that ratio was when they negotiated the contract's estimated cost. At this point, given the facts presented, I don't see a way for the contracting officer to force the contractor to change its billing rates. What's likely to happen is that the contractor will burn through its funding quicker than the parties intended ... and the contracting officer will then have leverage to force a change in contract terms (i.e., a third billing rate for teleworking employees) as a condition of either providing more funding or exercising the next Option Year. There will also be an opportunity in the CPARS rating to make any displeasure known.

-

49 minutes ago, Vern Edwards said:

Even more, if the work is not physical, why care where it’s done? I’m sitting in a plane enroute to New Bedford MA for the Moby Dick Marathon Read this weekend. It’s a five hour flight. I just finished an article for which I’ll be paid. Where was I when I typed each word? Who cares? Why pay different amounts for the same work done in different places if the place does not affect the work?

You know, the FAR addresses this point (somewhat).

Quote31.203 Indirect costs.

*****

(c) The contractor shall accumulate indirect costs by logical cost groupings with due consideration of the reasons for incurring such costs. The contractor shall determine each grouping so as to permit use of an allocation base that is common to all cost objectives to which the grouping is to be allocated. The base selected shall allocate the grouping on the basis of the benefits accruing to intermediate and final cost objectives. When substantially the same results can be achieved through less precise methods, the number and composition of cost groupings should be governed by practical considerations and should not unduly complicate the allocation.

*****

(f) Separate cost groupings for costs allocable to offsite locations may be necessary to permit equitable distribution of costs on the basis of the benefits accruing to the several cost objectives.

The theory is, when the government provides facilities then it's duplicative for the contractor to allocate to that same contract indirect costs that contain the contractor's facility expenses.

-

9 hours ago, Don Mansfield said:

It seems unreasonable to charge the contractor site rate for an employee who would otherwise be working at the Government site.

Given:

(1) A choice between two rates and only two rates; and

(2) The rate to be used is dependent on the location where the work is actually performed; and

(3) The PWS expressly gives the contractor discretion to determine the work location.

Then I don't see how did you reached your conclusion, Don.

What about the situation makes use of the contractor's facility offsite rate "unreasonable"? Please cite to FAR 31.201-3 in your response.

-

In June, 2018, DCAA issued MRD 18-PSP-002 on the audit of contractor "Long-Term Agreements" (LTAs).

QuoteAn LTA is an agreement entered into between a prime or higher-tier contractor and a subcontractor to establish pricing for future purchases of specified items. It is common for contractors to enter into an LTA with a subcontractor in advance of a specific Government RFP; therefore, DCAA audit assistance may be necessary to ensure the reasonableness of the subcontract price. Before initiating the audit, the following is required:

1. The subcontract proposal has been approved by the appropriate subcontractor management;

2. The prime contractor has submitted the subcontract proposal to the Government with an assertion from the prime contractor’s management that it intends to award an LTA with the subcontractor and identifies the benefit of the LTA to the Government;

3. The subcontract proposal is adequate for examination based on the requirements set forth in FAR Subpart 15.4, Contract Pricing; and

4. The Contracting Officer has determined that subcontract audit support is required based on DFARS PGI 215.404-3 Subcontract pricing considerations.

The MRD contained a FAQ Section:

QuoteQuestion 3: Are LTAs an acceptable pricing method on Government proposals?

Answer: LTAs are an acceptable pricing method since FAR allows a prime contractor to reach a price agreement with a subcontractor in advance of an agreement with the Government. Therefore, it is common for prime contractors to submit independently a request for quote to its subcontractors in anticipation of future Government solicitations. The prime contractor might be establishing a business arrangement that addresses a specific expected prime level requirement (e.g., a specific annual procurement of a given weapon system) or it may be to satisfy multiple different procurements (e.g., multiple DoD and Foreign Military Sales (FMS) procurements for one or more weapon systems).

The prime contractor will use the long-term pricing agreements resulting from these requests as a basis of estimate in its cost estimates. FAR 15.404-3(c) provides that the contractor obtain and analyze certified cost or pricing data before awarding any subcontract expected to exceed the cost or pricing data threshold, unless an exception in FAR 15.403-1(b) applies. This requirement applies to all subcontract awards regardless of how far in advance a price agreement is reached (see FAR 15.404-3(c)(4)). If the subcontract value under the LTA is expected to exceed the cost or pricing threshold and none of the expectations in FAR 15.403-1(b) apply, the contractor must obtain and analyze certified cost or pricing data as of the date of the LTA execution.

(Emphasis added.)

-

You find Government Contractor M&A targets the same way you would any other acquisition target.

-

30 minutes ago, Vern Edwards said:

The notion that the government can ever participate in the commercial marketplace like any other participant is fantasy.

*****

Get it?

QuoteBased on the foregoing, it does not matter that the contracting officer had no actual knowledge of the terms of the licensing agreement. The circumstances support finding the contracting officer had a duty to inquire as to its terms, which he failed to do, and to impute knowledge of same to him. Accordingly, based on the fact that it is, and has been, the policy of the federal government prior to the award of the contract to accept the terms of licensing agreements offered by vendors of commercial software that are customarily provided by the vendor to other purchasers and that vendors of commercial software have long included shrinkwrap and clickwrap license agreements with their software, which many courts have found to be valid, enforceable contract terms and the FAR currently also recognizes the validity of clickwrap and shrinkwrap licenses, we find the contract included the licensing agreement appellant shipped with 21 its software. We also hold the government can be bound by the terms of a commercial software license it has neither negotiated nor seen prior to the receipt of the software, so long as the terms are consistent with those customarily provided by the vendor to other purchasers and do not otherwise violate federal law.

CiyaSoft Corp., ASBCA Nos. 59519, 59913, 6/27/2018. (Emphasis added.)

-

On 12/16/2022 at 10:30 AM, FAR-flung 1102 said:

For the certificate or a pre-approval of some kind to be effective, it would need to involve a reliable assessment of the vendor's current terms and not just indicate their willingness to accept GPC.

Online vendors not willing to accept GPC is one thing (in my experience there are a few of those vendors).

It's another thing to have an online vendor whose routine practices involve terms that are contrary to those a GPC holder can accept while staying inside the bounds of federal law & GPC rules and regulations (in my experience there are a lot of these vendors).

Absent some sort of pre-approval or implementation of a portal, the issue of unacceptable terms can easily get missed or misunderstood by the only Government personnel in a position to spot it before the purchase happens: a GPC cardholder or their approving official.

And even when spotted ahead of time, resolution may not be easy. Online vendors would probably have little ability or incentive to change their business system accommodate the unique needs of a party wanting only one or a few purchases.

I've seen one such GPC issue elevated all the way to an agency Chief of Procurement who engaged with the company head before concluding that source could not be used.

In 2015 GSA a GSA identified 15 types of terms commonly used by vendors in their agreements that the federal Government cannot agree to...I've linked to it recently in another thread.

I don't really doubt you're correct in your assessment of the situation. But to me, what you are saying is that when the government enters the marketplace to acquire commercial items, it is unable to conform to standard marketplace practices and standard terms and conditions. In my mind, that kind of makes a mockery of the entire "commercial goods" and/or "commercial services" concept.

If a buyer can't accept what the marketplace is offering, then the notion of market-determined price reasonableness goes out the window.

-

2 hours ago, Sam101 said:

Thanks H2H.

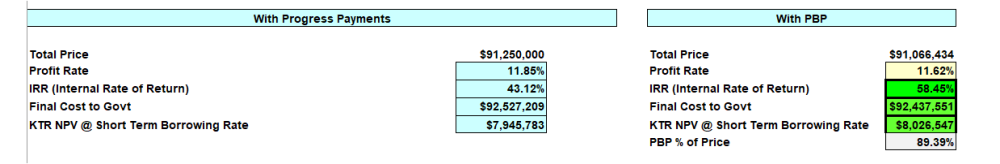

So, with the proposed price on the SF33 is $91,250,000. The win-win solution with PBP says $91,066,434.

But am I understanding correctly that the government still awards the contract (i.e., obligates) $91,250,000.00? And then during performance the PBPs will look exactly like on cells in column H? But the invoice payments in column I (i.e., DD 250) will have an extra invoice for the $183,566.00 difference?

I don't see it that way. However I have already caveated that I'm not an expert in how DoD does PBPs. In my view, the tool is telling the DoD CO to negotiate the lower price of $91,066,434 if the contractor is permitted to use PBPs instead of progress payments based on (adjusted) costs incurred. I would expect the amount obligated to be equal to the price of the contract awarded.

-

I guess I'm just naïve. If the goal is to buy commercial items, why don't the holders of the GPCs just do a Google (or Bing) search for what they need? Why does the Gov't. require a unique system to replicate what the market already provides?

-

With respect to performance-based payments, DoD mandates the use of a "tool" (spreadsheet) that takes into account both the contractor's interest rate on its borrowings as well as the A-94 interest rate. No I don't know the rationale for doing so. Most of how DoD implements PBPs is a mystery to me. I just know that the spreadsheet exists and can be accessed by those who need to use it.

-

Are we talking about cost-based customary progress payments or are we talking about performance-based payments? This reader is confused.

.gif)

Cost Plus Fixed Fee - Rate Increase

in Contract Administration

Posted

Joel, I'm sorry I wasn't clear. My statement: "…but the contractor is still expected to perform the contracted work" was in the context of a FAILURE to comply with the requirements of the clause(s).