xanadu

Members-

Posts

23 -

Joined

-

Last visited

Reputation

0 NeutralRecent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

Size standards change due to inflation

xanadu replied to xanadu's topic in Proposed Law & Regulations; Legal Decisions

Thanks Vern. Always appreciate your insightful thoughts/comments. Definitely an interesting perspective. I talked to a few folks and it does look like the new increased $$ will stick and they have not seen numbers adjusted down after an interim final rule. That was the reason I wanted to know if the experts saw anything differently in their experience. Thanks again for the thoughts. -

xanadu started following Size standards change due to inflation

-

Good afternoon. Do the experts here have any thoughts or opinions on this significant change to the size standards due to inflation - https://www.federalregister.gov/documents/2022/11/17/2022-24595/small-business-size-standards-adjustment-of-monetary-based-size-standards-disadvantage-thresholds Especially since some of the revenue averages were only recently updated (for eg: revenue for NAICS 541611 was recently increased to $21.5 million earlier this year). And, SBA published it as an interim final rule already and not sure if they intend to revert or make changes down based on comments from the industry. Thank you for the thoughts as always!

-

Thanks for the response, Formerfed. We are hoping for the JV to have an 8(a) status to pursue 8(a) opportunities. I don't believe a CTA with a firm that is not an 8(a) would afford the same status. But it is possible I am missing something. If we form a CTA with the 8(a) protege as the "Team Lead", I am not sure if the CTA can pursue 8(a) procurements ?

-

Thank you for the response. I already reached out to our SBA rep and he mentioned that the rules are changing and the process is less onerous in terms of documentation for SBA after 11/16/2020. And, I read the FAR clause you described, multiple GSA websites and material and also multiple posts on this forum and still didn't receive the answer. I sent a note to our SBA rep this morning asking the question directly - after reading your post. But if anyone on this forum has experience dealing with MAS schedule through a JV, I was wondering if they can chime in. Thats all. Thanks again for taking the time and pointing me to the FAR clause.

-

Good afternoon. I am asking this question in the context of the recent SBA JV rule changes and also with the GSA MAS schedule consolidation happening in parallel. Context and background 1. We are a protege in a SBA-approved Mentor-protege relationship. The mentor is a firm that graduated from the 8(a) program and is a mid-size business now 2. Both the mentor and protege have our own GSA schedules and we are delivering on contracts awarded through the GSA schedule to each of the firms individually. 3. We recently decided to form a Joint Venture and have signed a Operating Agreement. Questions 1. How easy is it to get a GSA MAS schedule awarded to the JV directly. I was told that the JV has to be existence for 2 years along with the requirement to submit financial statements. The firms are in existence for many years now but the JV is new. Do we have to be performing the work as a JV already ? Will this be deal-breaker for the JV to be awarded the schedule - that the JV is new and there is no work performed under the JV? Follow-up question - if the JV can be awarded a GSA MAS schedule, can we combine the labor categories on each of the firm's GSA schedule for the JV's GSA schedule? 2. Do any of the recent JV or GSA MAS schedule changes cover this situation? Thank you in advance.

-

G&A on subcontractor costs

xanadu posted a topic in Contract Pricing Including CAS & Allowable Costs

Hello, I need some help from the FAR and pricing experts. This has been an old topic on this forum and I found other threads on it - about how much G&A can be applied on subcontractor costs and not seem "excessive". This post I found is the most detailed and on-point in my mind - https://graniteleadershipstrategies.com/government-contracting-when-to-add-a-subcontract-handling-pool/ So, here is a situation. Lets say we are a small business prime with a significant G&A rate (we are in our growth phase). Can we apply a lower G&A on our subcontractors to be competitive on a Cost-plus bid? But we still have to collect costs in the accounting system by applying all G&A on subs keeping the "Total cost input" method, right? We do not have a subcontractor handling pool and that would bring its own set of challenges by increasing our G&A further and am trying to avoid that. Are we breaking any rules and upsetting procurement Gods by reducing G&A in the bid but in turn apply all of it in execution when we collect the costs? If we discount the G&A on a bid, do we have to discount it consistently in every bid? Thank you for your guidance. -

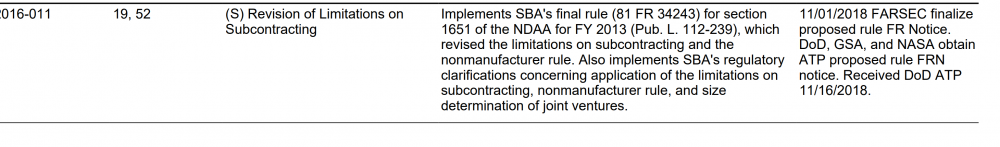

It is definitely a sad state of affairs. I am not sure what is causing this level of significant delay after the law has been signed back in 2013! I can only imagine the comments on the proposed rule must have been overwhelmingly strong and would encourage the FAR council to move forward. I found this FAR timeline image and it hurts me to say that it doesn't look like the change will be implemented until 2020 - are you guys reading this differently? The change from interim rule to proposed rule (again!) put us back by 18-20 months!! Image for the FAR Timeline

-

Limitations on Subcontracting - Update

xanadu replied to xanadu's topic in Proposed Law & Regulations; Legal Decisions

Thank you Joel and Pepe - appreciate the response. The fact that it was published on the "FARsite" made be think if it applies to all contracts where FAR clause is included. I didn't know FARsite language applies only to DOD contracts. If the FARsite is not right place, where is the "system of record" for FAR? Also, does "class deviation" only apply if someone within the department sends a letter like the DoD one? I am trying to figure out who to hound next 🙂 EDIT - May be this is the place? https://acquisition.gov/content/52219-14-limitations-subcontracting -

Limitations on Subcontracting - Update

xanadu replied to xanadu's topic in Proposed Law & Regulations; Legal Decisions

Don, based on the fact that the FARsite has been updated with the class deviation, does this mean this language will apply to all federal contracts? Thank you -

Limitations on Subcontracting - Update

xanadu replied to xanadu's topic in Proposed Law & Regulations; Legal Decisions

You said the "most recent version" of the FAR but this class deviation was only incorporated effective 12/4/2018 (and thank you for pointing that out!). This particular sentence is what I am looking at - " Services (except construction), it will not pay more than 50 percent of the amount paid by the Government for contract performance to subcontractors that are not similarly situated entities. Any work that a similarly situated entity further subcontracts will count toward the 50 percent subcontract amount that cannot be exceeded;" What is the legal standing of a "Class deviation". Does this mean the FAR has been updated? or is there any ambiguity to apply this to all federal contracts? Thank you for the confirmation. -

Limitations on Subcontracting - Update

xanadu replied to xanadu's topic in Proposed Law & Regulations; Legal Decisions

No problem Neil and it is probably my mistake. Other than following this particular thread for purely selfish interests, my interest and knowledge in FAR updates is minimal and I probably used the wrong words. But this is what I was referring to - https://www.federalregister.gov/documents/2014/12/29/2014-29753/small-business-government-contracting-and-national-defense-authorization-act-of-2013-amendments " Specifically, the NDAA provides that a small business awarded a small business set-aside, 8(a), SDVO small business, HUBZone, or WOSB/EDOSB award “may not expend on subcontractors” more than a specified amount. However, as noted below, work done by “similarly situated entities” does not count as subcontracted work for purposes of determining compliance with the limitation on subcontracting requirements. Proposed §§ 125.6(a)(1) and (a)(3) would address the limitations on subcontracting applicable to small business set-aside contracts requiring services or supplies. The limitation on subcontracting for both services and supplies is statutorily set at 50% of the award amount received by the prime contractor. See 15 U.S.C. 657s(a). Proposed § 125.6(a)(3) addresses how the limitation on subcontracting requirement would be applied to a procurement that combines both services and supplies. This provision would clarify that the CO's selection of the applicable NAICS code will determine which limitation of subcontracting requirement applies. Proposed §§ 125.6(a)(4) and (5) would address the limitations on subcontracting for general and specialty trade construction contracts. SBA proposes to keep the same percentages that currently apply: 15% for general construction and 25% for specialty trade construction. As noted above, the NDAA prohibits subcontracting beyond a certain specified amount for any small business set-aside, 8(a), SDVO small business, HUBZone, or WOSB/EDOSB contract. Section 1651(b) of the NDAA creates an exclusion from the limitations on subcontracting for “similarly situated entities.” In effect, the NDAA deems any work done by a similarly situated entity not to constitute “subcontracting” for purposes of determining compliance with the applicable limitation on subcontracting. A similarly situated entity is a small business subcontractor that is a participant of the same small business program that the prime contractor is a certified participant of and which qualified the prime contractor to receive the award. Subcontracts between a small business prime contractor and a similarly situated entity subcontractor are excluded from the limitations on subcontracting calculation because it does not further the goals of SBA's government contracting and business development programs to penalize small business prime contract recipients that benefit the same small business program participants through subcontract awards. -

Limitations on Subcontracting - Update

xanadu replied to xanadu's topic in Proposed Law & Regulations; Legal Decisions

Thank you. This means that the new "proposed rule" published will go through its own publication life cycle (may be 6 more months?!) and departments/agencies can create such deviations in parallel. They already published this proposed rule earlier and received feedback - I wonder why they had to do it again!! Sigh!!! -

Limitations on Subcontracting - Update

xanadu replied to xanadu's topic in Proposed Law & Regulations; Legal Decisions

Thank you. Can you please be kind enough to translate this for me. What does this mean - "DOD Class Deviation"? I am assuming this applies to all federal contracts effective immediately or am I interpreting it wrong? But how is this different making the change the "final rule" instead of "proposed rule" ? Thanks again. -

Hello, Looks like there was an update on the "limitations on subcontracting" clause on the open far cases update on Friday. Can someone please help me interpret this? Does this mean they are issuing another proposed rule and will collect comments again (frustrating!). Should we look for this now on the federal register or will there be any more steps before it gets there? Thank you for the feedback. EDIT - I found this on the federal register posted yesterday with a reference to the FAR clause ("Introduction to the Unified Agenda of Federal Regulatory and Deregulatory Actions-Fall 2018" - https://www.federalregister.gov/documents/2018/11/16/2018-24084/introduction-to-the-unified-agenda-of-federal-regulatory-and-deregulatory-actions-fall-2018

-

Just a quick update. I talked/emailed the House Small Business Committee to see if they heard from OMB (the letter states that they would like to get the response by 9/28). I received a response very quickly that they are still waiting to hear back from OMB. At least, someone is monitoring the situation. Also, does the change to "proposed rule" from "interim final rule" mean that they would be publishing the rule for public comments again? If that is the case, this another year long process!

.gif)